The Free Port Of Trieste

The Free Port of Trieste was established by the Austrian Emperor Carlo VI in 1719 and strongly developed by his daughter Maria Teresa who considered Trieste as the only Port of the Austrian Empire.

The 1947 Paris Peace Treaty and the Memorandum of London in 1954 maintained the Free Port of Trieste’s legal and fiscal regime, thus giving it an extra-territorial status. Since that time, customers can benefit from special conditions for both import, export and transit operations, customs procedures and fiscal regime.

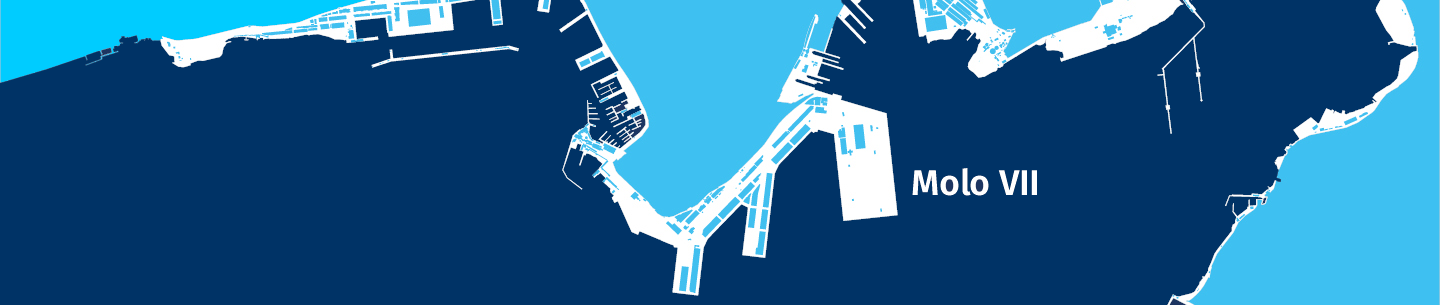

The Porto Franco or Free Port has 5 “free ports” (Punto Franco Vecchio, Punto Franco Nuovo, Punto Franco Scalo Legnami, Punto Franco Oli Minerali and Punto Franco Industriali).

Few basic info about the peculiarities of the free port of Trieste:

-

Import Cargo

Import goods can be immediately discharged, no matter the nature of goods, the origin, or the destination. Discharge or transhipment operations do not need any specific authorization.

Operators can immediately prepare all the documents for import or transit, allowing goods to immediately proceed to their destination.

Goods discharged at Trieste are considered “in transit” and are exempted from duty payment as long as they remain within the Free Port Area.

All the above conditions have been maintained after the introductions in January 1st 2011 of the new European Community security control rules.

-

Export cargo

Goods coming from EU Countries entering into the Free Port Zone are considered “exported” from the European Community.

Once the container enters the free port area, it can be loaded onboard without waiting for specific authorizations (if customs clearance has been carried out).

-

VAT and Duties Payment

For goods imported into the EU through the Free Port, Customs duties and VAT payments can be postponed up to 6 months. The interest rate applicable is very low: 50% of the 6 months Euribor rate.

-

Maritime Duties

At the free port of Trieste, maritime duties are calculated on the basis of preferential rate.

-

Storage of Goods

The importer is not compelled to assign a customs status to the goods. As per law, in all the Customs Ports, goods have to receive a customs status (import/transit/depot) within 45 days. On the contrary, in the Port of Trieste, goods can maintain an undefined status as long as they are in the Free Port.

-

Vessels

In the Free Port Zone of Trieste, all vessels (no matter the vessel flag) are considered to be the same as the Italian flag as far as the Maritime duties (former light dues) are concerned.

-

IT System

The Port of Trieste complies with the CARGO – A.I.D.A. system requirements. The system provides to all the operators, in Italy and other EU Countries, additional on line information about the cargo status also under the customs point of view. The peculiar rules and regulations of the Free Port will be maintained thanks to an integrated IT system able to comply with the CARGO-AIDA requirements and the Free Port peculiarities.